Reckon Customer Portal

How to - Reckon Customer Portal

Getting Started

Changing from a Single Sign On (SSO) Login to Username/Password

Creating an Account

Updating your Details

FAQ - Customer Portal

Products

Partners

Troubleshooting - Reckon Customer Portal

Reckon One

How to - Reckon One

Getting Started - Reckon One

Day to Day

Recurring Transactions

Estimates

Invoices - Reckon One

Customer Adjustment Notes

Receive Money

Bills - Reckon One

Supplier Adjustment Notes

Make Payments

Chart of Accounts

Projects

Items

Timesheets

Expense Claims

Journals

Customer Statements - Reckon One

Contacts centre

Reckon One: Contacts

Payroll

Upgrading to the new experience

FAQ's - upgrading to new Reckon Payroll experience

Viewing YTD values in the new experience

Accessing and upgrading to Reckon Payroll from Reckon One

There is an issue with your account! - Error when accessing Reckon Payroll

Quick Guide

Pay Items

Employees

Employee invitation

Processing a Pay Run

Processing SuperStream in Reckon One and Reckon Payroll

Super Funds

Single Touch Payroll - Reckon One

Processing EOFY - Reckon One

Payment Summaries

Processing Payments

Using Reckon One Timesheets with Payroll

Lodge Tax File Number (TFN) Declaration

FAQ - Reckon One STP

Banking

What's New in Banking

Bank Accounts - Reckon One

Bank Transactions

Suggested Matches

Allocate Transactions

Reckon One Transactions

Fast Coding

Reconciliation - Reckon One

Reconciling your accounts

Undoing a bank reconciliation

Transfer Money

Transaction Rules

Bank Payments

Reporting

Features

Document Storage

Reckon One Search

Grossed-Up Transactions

Classifications

Column Filters

Import Chart of Accounts

Book Settings

Day to Day Settings

Template Settings

Money in Settings

Money out Settings

Time settings

Reckon One: Statements Settings

Employee expenses Settings

General Settings

Payroll Settings

Tax Settings

Reckon One: Contact Detail types

Integrations

Payment Services

Zapier

Zapier

Zapier and Shopify

Zapier - create an invoice or receipt

Zapier Action - Create an invoice in Reckon One

Reckon Ecommerce

Dashboard

User Guides - Reckon One

Support

Reckon One FAQ

Reconciling External Merchant Fees

Troubleshooting - Reckon One

Reckon One UK troubleshooting

How to unlock the bank account that has been locked after reconciliation.

Processing Time In Lieu in Reckon One

Error – the value ‘/Date(14749879800000)/’ is not valid for StartDate

Preparing Reckon One for Single Touch Payroll, (STP)

Postings don’t balance when entering a Journal.

Error: Line item does not have a number, when entering TimeSheet entries on an Invoice

Recording RCTI in Reckon One or (buyer created tax invoice)

‘Pay run error: the number credit is outside the valid range’ when finishing the termination payrun.

How to update YTD balances on the Payment summary in Reckon One

Can’t add a tax code to a transaction in the Payments and Receipts window of CashBook.

STP Screen has Doubled Up Employees & Gross Amounts in Reckon One

Invoice shows Due Date one day before Invoice Date

Delete the bank transactions (QIF/CSV file) in bulk that was incorrectly imported.

Creating customer statements

Writing Off Bad-Debts in Reckon One:

How to enable/process Taxable Payments Annual Reports (TPAR) in Reckon One.

Text on Reckon One new design is not properly aligned

Access Denied or You do not have enough access rights ... attempting to view a Book on Mobile App

Credit Card transactions no longer available in Reckon One after creating a new Yodlee feed

Recording SuperStream payments in Reckon One

BankData signup & configuration for Reckon One

Invoices print with part of top and left side cut off

Create new user in Reckon One, Delete the user, share the book with accountants

“Invalid Company Information error” in GovConnect STP when submitting pays from Reckon One

Manually Importing PayPal fee transactions.

How to link Bankdata feeds and allocate transactions in Reckon One

"An error occurred while processing your request or the page you last visited does not exist anymore" when create/view a TPAR report

Transaction rule does not pick up the transaction

How do I enable Leave Loading to be included in Super calculations in Reckon One?

Downloaded Bankdata transactions disappear from a Reckon One Book

Setting up and processing Payroll in Reckon One.

Configuring and Understanding PayPal integration in Reckon One

Enter opening balances in Reckon One

How to update the billing information in Reckon One? How to change the credit card details

Cannot process a downloaded Bank Transaction - <> characters in the Description field.

How to add or change or purchase the new modules? Activate /Deactivate Modules

How to Setup and Calculate Super in Reckon One

Downloaded bank transaction does not allocate to bank ledger accounts

No ability to unlink a bank ledger account from a bank feed

How to purchase the expired trial book?

“Error reading selected bank transactions” when clicking on Reconcile on the Banking Screen

Processing GST payable and GST refunds to and from the ATO in Reckon One

Last financial year to date report does not show transactions to today

Error: The journal does not balance when marking pay run as Paid

Latest Bankdata transactions not available in Reckon One Book.

How to enable Estimates or Quotes feature in my Book?

Editing and creating a new ABA file with an updated amount

Portal: Unable to modify user because R1 Request Failed

Entering Gross Amounts (Tax inclusive) or Net Amounts (Tax exclusive) in your transactions.

Why do I get an Error 522 when I attempt to add my bank account to my BankData record through Yodlee

How to edit/delete the paid invoices in Reckon One?

Submitting an STP Update Event or Full File Replacement in Reckon One

Setting up a BankData account on Reckon One

Payable Type field in Reckon One

Unable to login to Reckon One Portal when Ad-blocker is installed.

Looping issue when creating new Book.

How to Submit a Nil STP Submission to the ATO using Reckon One

Grey Screen When Trying to Print in Reckon One

How to process the Termination in Reckon One?

How to enter a Director’s Loan into a Reckon One Book

Credit for GST tax paid on BAS does not match GST on Purchases on GST Summery Report

How to lock or unlock the book.

Processing SuperStream in Reckon One

Manually Importing PayPal transactions

Deleting a Reckon One BankData subscription

An error occurred submitting single touch payroll details to the API

Super is not calculating

Entering the FBT amount on the Payment Summary in Reckon One

Error - Tax code cant be entered for non-taxable items

The opening balance changes in a reconciliation when a transaction from previous month, is reconcile

Creating an ABA file for batch payments processing in bank, from Reckon One.

How do I enter ACN in Reckon One?

SSO (Google/Microsoft) accounts are unable to login from Mobile App.

Supplier Overpayment

Duplicate Pay Runs Automatically Created in Reckon One

Understanding RESC in Reckon One

Receiving a cash refund for an overpayment of a bill.

Refund customer overpayment

Connecting your Book to your BankData feeds

Forcing an immediate update of your Yodlee bankfeed

STP Payrun Has No Figures Appearing

Removing an account from your Reckon One BankData Record

Importing PayPal transactions and matching with my records from PayPal payment services.

How to switch the ownership of a bank feed

How to close a BankData Account in Reckon One

Creating a new role for a user in Reckon One.

Reckon Payroll

Reckon Payroll - App

How to - Reckon Payroll App

Single Touch Payroll Phase 2 - Reckon Payroll App

How to prepare for Single Touch Payroll Phase 2 - mobile app

Preparing Employees for Single Touch Payroll Phase 2 - mobile app

Prepare Earnings for Single Touch Payroll Phase 2 - mobile app

Preparing Allowances for Single Touch Payroll Phase 2 - mobile app

Preparing Leave for Single Touch Payroll Phase 2 - mobile app

Other leave Single Touch Payroll Phase 2 - mobile app

Switch to STP Phase 2 - mobile app

Reckon Payroll | STP Phase 2 Checklist | Phone Browser

Getting Started - Payroll App

JobKeeper Items - Payroll App

Adding Employees - Payroll App

Creating a Pay Run - Payroll App

Reports - Payroll App

Settings - Payroll App

Invite employees to Reckon Mate from the Reckon Payroll mobile app

End of financial year report - Payroll App

Revoke employee access to Reckon Mate from Reckon Payroll mobile application

Migration to Reckon Payroll app

Reckon Payroll: Set up Pay Schedules on the Payroll app

Manage Company bank details

Manage pay schedules

Manage superannuation funds

Manage Earning items

Manage Leave items

Manage Allowance items

Manage Deduction items

Manage Reimbursement items

Manage Superannuation items

Maintain employees pay schedule

Maintain employee bank accounts

Maintain employees superannuation

Maintain employee pay setup

Reckon Payroll App: Pay an employee reimbursement

Terminate an employee and complete final pay

Pay an employee Back Payments, Commissions, Bonuses and similar payments

Pay an employee return to work payments

Use tax table for daily and casual workers

Reckon Payroll: Pay unused leave on employee termination using Schedule 7 – Tax table for unused leave payments on termination of employment

Troubleshooting - Reckon Payroll App

Reckon Payroll - Web

How to - Reckon Payroll Web

Single Touch payroll Phase 2 - Reckon Payroll Web

How to prepare for Single Touch Payroll Phase 2 - Reckon Web

Preparing Employees for Single Touch Payroll Phase 2 - Payroll Web

Preparing Earnings for Single Touch Payroll Phase 2 - Payroll Web

Preparing Allowances for Single Touch Payroll Phase 2 - Payroll Web

Preparing Leave for Single Touch Payroll Phase 2 - Payroll Web

Preparing Other Leave for Single Touch Payroll Phase 2 - Payroll Web

Additional STP Phase 2 checks

Pay runs

Calculating tax for daily and casual workers

Paying a Company Contribution

Paying a Reimbursement - Reckon Payroll

Entering back payments, commissions, bonuses and similar payments

Processing a termination pay

Employees

Invite employees to Reckon Mate from Reckon Payroll web

Adding a Company Contribution to an Employee

Rehire an employee in Reckon Payroll

Assigning YTD values to employees

Compliance

Settings

Settings overview - Reckon Payroll (Web)

Creating an employee super fund in Reckon Payroll Web

Set up pay schedules on the Payroll App (web access)

Creating a custom super item in Reckon Payroll Web

Managing Pay items for Back Payments, Commissions, Bonuses and similar payments

Managing Company Contributions

Manage Leave Balance for Pay Slips in Reckon Payroll

Managing Reimbursements

Getting Started - Reckon Payroll for Web

How to include time worked leave accruals in pay items - Reckon Payroll

Troubleshooting - Reckon Payroll Web

Reckon Invoices

Reckon Invoices App

How to - Reckon Invoices app

Getting started - Reckon Invoices app

Creating a customer & contact - Reckon Invoices App

Creating an invoice - Reckon Invoices App

Approving an invoice - Reckon Invoices App

Sending invoice - Reckon Invoices App

Delete account - Reckon Invoice App

Release Notes - Reckon Invoices app

Reckon Accounts

How to - Reckon Accounts

Reckon Accounts - Payroll

Reckon Accounts - Single Touch Payroll (AU)

Reckon Accounts - STP Phase 2

Reckon Accounts - STP Phase 2 Requirements

Reckon Account - STP Phase 2 - Tax Treatment Code

STP Phase 2 - Tax Treatment Code in Reckon Accounts 2023

STP Phase 2 - Income Type in Reckon Accounts 2023

STP Phase 2 - STP Tax Category in Reckon Accounts 2023

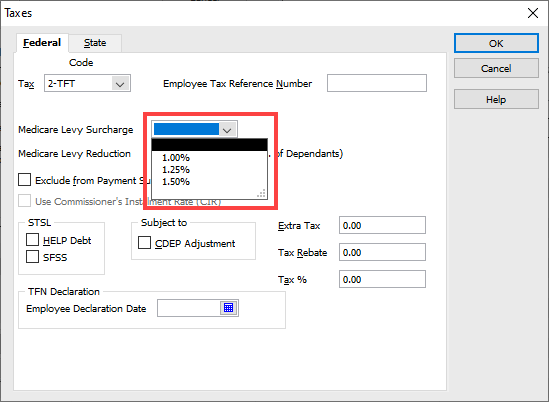

STP Phase 2 - Medicare Levy Surcharge in Reckon Accounts 2023

STP Phase 2 - Medicare Levy Reduction (No. of Dependants) in Reckon Accounts 2023

STP Phase 2 - How Tax Treatment Code is designated in Reckon Accounts 2023

ATO Tax Treatment Code Matrix in relation to Reckon Accounts 2023

Reckon Account - STP Phase 2 - Disaggregation of Gross

STP Phase 2 - Disaggregation of Gross

STP Phase 2 - Tax Tracking Type changes in Reckon Accounts

Permissible Income Tax Tracking Types per Income Type

STP Phase 2 - Payment type codes in Reckon Accounts

STP Phase 2 - Employment Basis in Reckon Accounts 2023

STP Phase 2 - Cessation Type in Reckon Accounts 2023

Reckon Accounts - STP Phase 2 Migration Assistant Pages

Reckon Account - Prepare Employee Details

Prepare Employee Details: Available options

Prepare Employee Details: Permitted and available fields

Prepare Employee Details: Validations based on selections

Migration Assistant: Welcome/Resume Page

Migration Assistant: Prepare Employee Details

Migration Assistant: Prepare Gross Wages Items

Migration Assistant: Prepare Allowance Items

Migration Assistant: Prepare Leave Items

Migration Assistant: Completion page

Overview of the STP Phase 2 for Reckon Accounts

STP Phase 2 - Employer Checklist of key changes

STP Phase 2 - Company changes in Reckon Accounts

STP Phase 2 - Employee detail changes in Reckon Accounts

STP Phase 2 - IIF changes for Export/Import

STP Phase 2 - Frequently Asked Questions (FAQ)

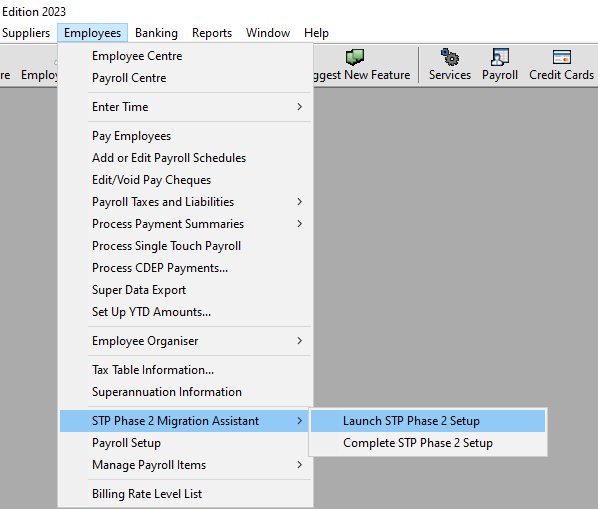

STP Phase 2 Migration Assistant

STP Phase 2 changes in Reckon GovConnect

STP Phase 2 - Known Lodgement error messages from Reckon GovConnect using Reckon Accounts

Year-end finalisation (EOFY) in Reckon Accounts 2023

Account Numbers are disabled after launching the Migration Assistant in Reckon Accounts 2023

Handling All purpose allowances with Overtime in Reckon Accounts 2023

STP Phase 1

Single Touch Payroll - Reckon Accounts

Preparing your Company File - Reckon Accounts

Final Pay Event

Transmitting Data to GovConnect

Pay Event

Pay Event Types

Update Event

Full File Replacement

EOFY Finalisation (STP Phase 1 - 2018) - Reckon Accounts

FBT Reporting

BAS Prefill - Reckon Accounts

FAQ - Reckon Accounts STP

BAS W1 Prefill on the ATO Business Portal displays the incorrect balance of Total Gross with Salary Sacrifice

Employees

Reckon Accounts - Multiple Tax Table Support

JobKeeper Payment

JobMaker Credits

Reckon Accounts - Legislative Changes

Reckon Account - 2023

QLD Mental health levy update for 2023

Handling Paid Family and Domestic Violence Leave (PFDVL) in Reckon Accounts

Reckon Account - 2022

NSW State Payroll Tax Rate update for 2022

Important changes to Super Guarantee for employees under 18

Reckon Account - 2020

Payday filing (NZ)

Payday filing (NZ)

Employment Information (EI)

Preparing your Company File - Reckon Accounts Payroll

Advance Holiday Pay

Handling Super Salary Sacrifice in QuickBooks QBi series

Setting up a non-super Salary Sacrifice item for a salary package

Tips for uploading tax reports to the NZ Internal Revenue Department

Reckon Accounts: FBT details do not print on BAS form

Reporting Super for Contractors

Creating a Leave Taken Report in RA Enterprise 20** and earlier

Setting up a non-super Salary Sacrifice item (Novated Lease/ Salary packaging)

Create Casual Loading Item

Installation/Activation Topics

Upgrading to QuickBooks 2002 Trial on a Windows Vista and later PC, as part of an upgrade process

Installing Quickbooks on a Small Business Server 2011

Reckon Accounts and Windows 10.

How to Activate Reckon Accounts Business / QuickBooks

Installing QBi on a Windows Server and Terminal Server – 2003 & 2008

Guides on installing Reckon Accounts Business in the Multi user environment

Company

Changing the title of Reports in Reckon Accounts

How do I add my company logo to sales and purchase order forms?

Secondary ID

Special Tags

Banking

Emailing and Reporting Topics

How do I see the WC code uncombined in reports?

How do I generate a report that displays the transaction details (splits) for a specific account?

Using Yahoo! Mail third-party App Passwords for Email Service Connection issues when emailing

How to continue using Gmail when Google 'Less secured app' is removed

Customers

How do I invoice a customer for a part or percentage of an estimate?

Links

Find an item by Barcode on Sales Receipts

Find an item by Barcode

Payment Receipt

Suppliers

Handling a refund from a supplier?

How to handle a Refund from a Supplier.

Taxable Payments Annual Report (TPAR) in Reckon Accounts

User Guides

Installation & Upgrade Guide

User Guide - RA Business

Payroll Guide - New Zealand

Blank Tax Detail reports

How to handle Bad Debts

Writing off a Bad Debt in Reckon Accounts

Configuring your Invoice template for OVERDUE stamp

How do I add a logo to my invoices?

How do I change the default bank account QuickBooks uses in Pay Bills?

Backing Up and Restoring Data Files.

How to make Time in Lieu appear on the payslip in Reckon Accounts Business.

How do I print reports across a single page?

How Do I Use Discount Line Items?

How do I enable Leave Loading/Holiday Loading to be included in Super calculations in Reckon Accounts?

How do I add a text box to my custom forms?

Configuring Reckon Accounts Business and Hosted for SuperStream

How to view the QBwin.log file

How do I set up an opening balance for an Accounts Payable or Accounts Receivable account?

How do I apply tax codes to items sold to foreign customers?

How do I use the Pro Timer?

How to enable Taxable Payments Annual Report, assign Suppliers to the Report and process the report

How do I print a disclaimer or other standard text on my invoice?

How do I change the Title or Headings of my invoice?

Using a Profit & Loss Budget in Reckon Accounts Business

How do I Turn Inventory Tracking on?

How to make and assign a refund cheque to an unused payment for a customer.

Reckon Accounts Desktop: How do I create items for inventory?

How do I handle customer overpayments?

How to submit the TPAR file to the ATO

Importing and Exporting Templates.

How do I print cheques in batches?

How to connect a RA company File to Bankdata feeds

How do I turn on inventory in Reckon Accounts?

How do the user permissions to create and print reports work?

How do I enter or change the opening balances for my customers?

How do I remove field borders on invoice template?

How to process PAYG Tax and Tax Payable on a single cheque in QuickBooks

How do I enter a refund or rebate to a customer?

How to re-import a bank statement file (*.qif)

How do I get my logo copied into a form that I exported to another company?

How do I pay my credit card bill?

How do I open a company file that is on another computer or on a file server?

How to close a BankData Account with Reckon Accounts Business and Reckon Accounts Hosted

How to Submit a Nil STP Submission to the ATO using Reckon Accounts Desktop/Hosted?

How to set up the Schedule Backup function in Reckon Accounts 2023?

Measuring network performance ( transfer speed in Mb/s )

How to track workcover in QuickBooks (versions 2003 and later)

How to recover a failed import of BankData on desktop RAB.

How to stop reducing SG from Salary Sacrifice (new law effective from 1 Jan 2020) in Reckon Accounts

How do I Print a single journal entry

How do I memorise a transaction in QuickBooks?

How do I show Inventory items on an Open Purchase Orders Report?

How to merge list items to correct minor file corruption in lists.

How do I set up budgets?

How do I terminate an employee with a lump sum payment?

How to make and assign a refund cheque to an unused payment for a customer.

How do I print invoices that are not the standard size?

How do I unpay a bill?

How to handle a Recipient Created Tax Invoice (RCTI) in Quickbooks

How do I receive and deposit a payment from a customer?

How do I apply an existing credit to an invoice?

How to turn UAC on or off on a Windows 7 or Vista PC

How to merge bank accounts

How do I start QuickBooks without loading a datafile?

How do I time an activity?

I have a supplier who is also a customer. How do I show the bill and invoice as being paid when I owe the supplier and the customer owes me?

How do I track reimbursable expenses?

How do I pay a bill in Accounts Payable (A/P) in Reckon Accounts?

How do I change the Date of a report from United States format?

How to memorise a report.

How to set the default email program to work with QuickBooks for emailing invoices.

How do the Desktop options of the Desktop View in Preferences function?

How to make sure that online backup is backing up properly.

How to turn on .Net Framework 3.5.1 in Windows 7

How to Remove Bulk Forms to be Emailed in Reckon Accounts

How to Create a printable bill credit advice with item display when requesting a refund from a Supplier

How to backup the Windows Registry

How do I memorise reports?

How do I print my payslips?

How to stop the Auto-fill transaction feature

How to omit Customer:Jobs from the Customer Contact List

Importing accountant's changes

How do I create a cash flow report?

How do I track Payroll Leave Liability on my Balance Sheet?

How to claim Fuel Tax Credit in Reckon Accounts Business

Wine Equalisation Tax configuration for Reckon

How do I change the currency symbol on printed forms?

How to Process RDO in Reckon Accounts Business?

How to enter the FBT onto an employee’s record for STP or Payment Summary

Reckon Accounts Desktop: How do I customise the fonts on my forms?

How to improve the performance of your Reckon Accounts company file

How do I get a tear along line above the remittance advice in an invoice

How do I enter credit card purchases?

How to handle an unpresented cheque

How do I handle returned items on an unpaid invoice?

How do I generate a report that shows my customer balances?

How to create a GST Ageing Summary Report

Turning on Safe Mode in Windows 10

Reckon Accounts: How to pay the Australian Taxation Office by Credit Card

How do I change the opening balance for an existing account?

Turning on the Windows Built-In Administrator account

How do I customise the purchase order so the dollar sign won't appear?

How do I adjust inventory in Reckon Accounts?

How do I open a company file that is on another computer or on a file server?

How can I track different areas of my company separately by department or location?

How do I find out which transactions have No Tax Code?

Petty Cash Account

How do I print statements?

Exporting and importing your invoice and other templates from one file to another in Reckon Accounts

How do I update my leave liability?

How do I change the colour in my account register or write cheques window?

Adding templates to a new data file

How do I reset or change the cheque number counter?

Locating the Taxable Payments Annual Report electronic file

How do I enter a credit, refund, or discount I received from a Supplier?

How to merge duplicate records in the Chart of Accounts, Items, Customers, Suppliers, Other Names Lists

Creating a new test file in Reckon Accounts Desktop or Reckon Accounts Hosted

Font size is too small and not clear in Reckon Accounts

How to Verify Data and Rebuild Data in the Reckon Accounts Business Range (Desktop)

Reckon Accounts Business Range desktop or Reckon Accounts Hosted - Start a new file with no transaction history using the Clean Up Company function

How do I find the QBWIN.LOG (error log) for the Reckon Accounts Business Range (Desktop)

Troubleshooting - Reckon Accounts

Reckon Accounts - Installation, Activation, and Security Issues

Reckon Accounts is unable to detect an installation of Microsoft Internet Explorer

Error 1904 when installing Reckon Accounts on the same PC with MYOB Account Edge installed.

Reckon Accounts Desktop: Runtime error when installing

Why do I get an error iKernel.exe The system cannot read from the specified device when installing Reckon Accounts

Location of Program Files and Registry entries on Windows 7 64-bit operating system

Error 1935: This setup requires .NET Framework 1.1 when installing QuickBooks QBi 2008/09

Registration message: 'QuickBooks is deactivated.'

There was a problem loading registration support

There was a problem installing Microsoft Runtime Library (Error 1618 or 1612) when installing RAB

Crash: COM Error after installing Reckon Accounts

Reckon Accounts desktop crashing on startup in Windows Server. (Applies to all QuickBooks) or unable to register.

Install Shield Engine could not be installed error when installing a QuickBooks bridging version

Features are missing / unavailable after upgrading or reinstalling Reckon Accounts

Internal Error 2738 when installing application

Windows Installer information box opens when trying to install Accounts Business 2014

Unknown patch error when applying a QuickBooks patch or service pack.

Error 5003 0x8004ace8 when installing Reckon Accounts or Tax Table Update

MYOB Converter Installation files for QuickBooks/Reckon Accounts

Performing a clean un-install and re-install of Reckon Accounts Business

Setup failed to launch installation engine: Error loading Type Library/DLL

RegSvcs.exe error when installing Microsoft .NET Framework 1.1 on Windows Vista or Windows 7

Error -6005 when installing the Tax Table Update

Installing, Updating and configuring Reckon Accounts In windows server (terminal server)

Warning: The reg file qbcenters.reg could not be merged into the registry. Please contact Product Support.

Running your PC in Selective Startup to install or activate Reckon Accounts

Error H202 when installing RAB 2016 on a Server

Enabling the Built in Administrator in Windows

QODBC asking for an Activation Key a month after installing

Error 1904 Module C:\Program Files\Intuit\QuickBooks 20xx-xx\ICWrapper.dll failed to register when i

Internal Error 2753 qbserverutilitymgr.exe on completion of a QuickBooks installation

Installation Interrupted when installing Accounts Business

This app has been blocked for your protection

QuickBooks could not locate a valid Installation Key Code

Error 1920. Service QuickBooks Database manager Service failed when installing

Error: QuickBooks has a problem in reading this registration file: qbregistration.dat

C=5 error when first installing

Next button is greyed out when applying the QuickBooks 2008/09 Tax Table Update

Cannot install QuickBooks – problem in reading qbregistration.dat

Error 1911 when installing Reckon Accounts Business

Unable to uninstall Quickbooks - files in use

Reckon Accounts: "Error on Cached Wizard Page" when activating the software

QBiTools.dll and ACM.dll files are missing when launching QuickBooks

Windows Installer message box appears and prevents installation of Reckon Accounts business 2013

Removing uninstalled programmes with the Microsoft Tool

Installing QuickBooks QBi 2008/09 Retail Upgrade in Microsoft Vista

Invalid serial number when registering QuickBooks via the internet

Error - Quickbooks could not install QB toolbars in Word

Msvcirt.dll is linked to missing export msvcrt.dll

A required dll file is missing - Icg32.dll

Error 1327 The drive is invalid when installing QuickBooks

After installing QuickBooks 2002 - qbonli32.dll is linked to missing export icg32.dll

Error 1723 when installing Accounts Business 2014

Problem: Reckon Accountscannot complete the reconfiguration process... or Please insert the disk: QuickB

Setup has detected that an installation \ uninstallation of an application may not be complete

Reckon Accounts shows as not Activated.

An error occurred while attempting to reconfigure your new edition of Reckon.

Error 1603 when installing QuickBooks QBi or Reckon Accounts Business

Tax Table Update installs successfully but does not update an Accounts Business installation

The procedure entry point ucrtbase.terminate could not be located while installing RAB

Error 1603 There was a problem with installing "Flash Player 8"

Cannot find the language resource file dblgen9.dll error when opening RAB after a re-install

Error 1603 – flash Player failed to install, when installing Reckon Accounts Business

Error -6010, 100 or -6010, 0: Your Reckon Accounts installation may have been modified. Try re-installing Reckon Accounts and then try again.

Error 1904: ….. failed to register when installing Reckon Accounts

Installing multiple versions of QBi on the one PC

When I try to open Reckon Accounts I get an error Notification: !sz File Buffer .empty ()

Clean uninstall and reinstall of Reckon Accounts Business

Reckon Accounts - Network/Path (including Multi User) Issues

Cannot see mapped network drives for Reckon Accounts Business (formerly QuickBooks) on a Windows 8 P

When opening my company file, I received a message to use the company from a mapped network drive. H

‘You do not have sufficient permissions to delete files from this folder...’

Error -6000, -301: An error occurred when Reckon Accounts tried to access the company file

Error (-6094, 0) when opening Reckon Accounts on a Windows 7 Home Edition PC

Error H202 when switching to multi-user mode in Reckon Accounts Business

Persistent errors accessing and staying connected to a Reckon Accounts company file in a networked enviro

I cannot access financial details of credit memo in Multi user mode.

Error -6129, 101 An error occurred when Reckon Accounts tried to access the company file.

Error (-12,0) when opening a company file on a Terminal Server

Setting up Reckon Accounts Pro in multi-user mode

Error (-6129,0): Database connection verification failure, when opening or creating a company file

What activities can't be performed in multi-user mode?

Error code (-1, 0) An error occurred when QuickBooks tried to access the company file (2010-11)

Cannot see mapped network drives when using Windows 10

Error: Connection Has Been Lost, when working on a company file

How do I set up QuickBooks Pro to use Multi-user mode?

Reckon Accounts Desktop: Reckon can not support the stock change you just made in multi-user mode and needs to shut down

Reckon Accounts Business has encountered a problem and needs to close when launching it on a Windows

Errors H101, H202, H303, H505, -6177,0, -6123,0, -6000, -77, -80, -83 on network environment

-6123, 0: Connection to the Accounts Business company file has been lost

Reckon Accounts Desktop: Cannot open an Accounts Business company file on a network – Error 0xc0000022

Error message 6175,0 Reckon Accounts is trying to access the Company but the database server is not responding

Error (-6176,0) Reckon Accounts cannot get the network address of the server

"You must be in Single User Mode...." when making Inventory adjustments across a network.

Mapped network drives no longer available

Error -6144,-103 or -6144, 0: An error occurred while Reckon tries to access the company file

Reckon Accounts is unable to communicate with the company file on another computer

Memorised transactions with multi-user

Error (-6174,0): problem opening Quickbooks in multi-user mode.

Configuring my firewall/antivirus to work with Accounts Business in a multi-user environment

User unable to pay bills in multi-user mode

Error, "You do not have sufficient permissions to delete files in the specified folder.."

Error (-6000,-816) Unable to open database

You are attempting to login to a file already opened in Single User mode (Error -6073)

Reckon Accounts - Upgrade/Update Issues

Desktop Accounts Business takes a long time to load after upgrading computer

Error (-14102,0) or (-14108,0) when updating a company file in the latest version of QuickBooks

Reckon Accounts Business does not start on a newly upgraded PC

Converting Quicken Data to QuickBooks 2004

Font sizes on memorised reports do not upgrade correctly.

Error (-1,0) opening an upgraded Reckon Accounts company file for the first time

Company File corrupts on upgrade from QuickBooks 2007/08 to Reckon Accounts 2016

Upgrade to latest version does not retain words added to the Dictionary

After upgrading my data file, the item cost/sale price has changed?

Upgrade datafile Combined Tax Codes; Error C=343

Sales rep field and upgrades

What happens if I upgrade my QuickBooks company data file and run into an update issue?

Upgrading from a Trial Version.

Combined Tax Types have a zero rate after upgrading?

Lost logos and fonts when I upgraded QuickBooks 2002.

Using data files created from International versions on the Australian Reckon Accounts product.

Loan Manager details not available after upgrade

QuickBooks 07/08 crashes when upgrading a file from QuickBooks 2002.

Using data files created from International versions on the Australian Reckon product (Reckon Accounts).

Tax Line field when editing an account is missing after upgrading the data file.

Admin password for a Reckon Accounts Business upgrade

How do I upgrade my company file from QuickBooks V 7.4 to Quickbooks 2002?

Reckon Accounts - Backup (including Portable) Issues

Reckon Accounts: Software cannot allow multiple backups to be kept

Error: ‘this is not a valid Quickbooks datafile’ when restoring a backup

Customised Letter Templates are lost when a backup is restored.

Why can't I restore my backup? When I made the backup, QuickBooks indicated the backup process was s

File name you entered is too long or not a valid filename when restoring a backup

Reckon Accounts backup will not restore

Last used backup path does not appear when backing up Reckon Accounts Business 2013

Scheduled automatic backups are not created if your Windows User Account does not have a password

Why am I being asked to overwrite my existing portable company file in Reckon Accounts Hosted 2019?

Unable to restore a data file from a backup

Error (-6000,-80) when restoring a backup

Error: "You may not have enough space on your hard drive to complete this backup"

You may not have sufficient permissions to create a portable company file from this computer.

Reckon Accounts Desktop: A data problem prevents back up from continuing

Process is slow when performing a backup in Reckon Accounts

Error (-6155, 0) when trying to restore a backup

Reckon Accounts is Frozen or Not Responding When Performing a Backup

Reckon Accounts - Company File/Data File Issues

Fatal Error V8.0ar1 (M=1352 L=968 C=88 V=-30)

My company file is taking longer to open and process transactions. TLG file needs resetting.

I can't get into the company file for whatever reason ; can't open file

Locating Reckon Accounts -related files on your Windows Operating System

Why are new items, names, or accounts added to the top of the list instead of being incorporated int

Why can't I access the EasyStart Interview through the File Menu?

Unable to search for the item when in the transactions like invoices/Bills/Estimates etc.

Creating a new item crashes QuickBooks

Error: Your list of user names and passwords appears to have been tampered with, or has become damage

Dates appear incorrectly on the company Snapshot

The company file needs to be updated message when opening a client’s company file

QBWin.log error: LVL_ERROR—Returning NULL QBWinInstance Handle

'There are no more Files' error when saving the new file

QuickBooks Small Business cannot create budgets based on actual previous years data.

Program Message: "This file did not record the previous transaction.Rolling back to previous transaction" on opening QuickBooks

The 'Audit Company File' and 'Company Information' screens are reporting incorrect file information.

Open Previous Company List shows only the last company opened in Reckon Accounts

Data has lost integrity. How do I go about trying to correct this problem?

Sending a file via Reckon A3 for Data Recovery team

Unrecoverable Error when opening a QuickBooks data file with memorised transfers.

Data file is corrupt when verifying a newly created EasyStart company file

Locating Reckon Accounts company file on your PC.

Using the data file in a previous version of Reckon Accounts after converting to a newer version

Forgotten password to Reckon Accounts company file

Cannot delete accounts from a new company file

The file you chose is too long or is not a valid file name when adding a logo

Message: "No Company Open," "No Company Opened," or "There is no company file open"

Reckon Accounts Desktop: Changing your Company File password

Restoring a file from a later or non Australian version

Starting a new company file in Reckon Accounts Business

User is already logged in when opening a Reckon Accounts Business company file

Cannot open the company file error messages in Reckon Accounts Pro, Plus or Accounting

Fatal error message C=260

My dates are in American format or my currency is Pounds

Why am I receiving a Fatal Error that contains the value C=88?

What information is available to help me set up my type of business in Reckon Accounts?

Remove deleted company files from the No Company Open view and Open Previous Companies view

Reckon Accounts Desktop: Deleting Unwanted Files

Fatal error V8.0AR1 (M=1115, L=1836, C=47...)

Handling GST on Imported Goods in New Zealand Accounts Business

Tax Rego ID not retained on the Company Information page

Clean up Data process does not progress when you choose Remove ALL transactions

Maximum number of characters for Reckon Account data fields

Warning - The data file *****.QBW is not a QuickBooks file or it is damage and / or This data is from an older version of QuickBooks

Message: "This file is already in use. Select a new name or close the file in use by another application."

Tax Rego ID ABN ACN and PAYG Withholding

Warning: The file you specified cannot be opened. The Windows error is: The file exists.

Error -6150 , -1006: An error occurred when tried to create, open, or use the company file, or Error 80070057: There was an unexpected e

Choosing property management as COA when starting new company file

Fatal Error (m=1477, l=5748, c=43, v=0(0))

Reckon Accounts Desktop: File size does not decrease after performing Clean up Company Data

What should I do if I have forgotten the Reckon Accounts password?

Error (-12,0) when opening a company file

Transaction count Limitations in Reckon Accounts data file

Error -6000, -82: An error occurred when trying to open the file or An error occurred when Reckon Accounts tried to access the company file

Password removal Service:

When logging into Reckon Accounts I receive an error message contain Crash.dmp and Crash.xml and can not log in

Verify and Rebuild - Rebuilding a data file in Accounts Business

Open Previous Company List shows only the last company opened

Reckon Accounts Desktop: File from QuickBooks 2007/08 Failing To Upgrade to Reckon Accounts 2023

Reckon Accounts - Report, Printing, or Emailing (including Preview) Issues

Adjusting printing alignments for pre-printed cheques in Reckon Accounts

Tax Invoices appear under Purchases on a Tax Detail – Cash Net Report

Changes to Class on a Sales Receipt do not reflect on Reports

Trial Balance report is incorrect after upgrading to QuickBooks QBi 2008/09

Email provider changes when I change the Email Form in Send Forms

Company name not showing up in printed reports.

Error code -60 - unable to Save as PDF or email in Reckon Accounts Business 2016 R2

Multiple copies of the same Payment Summary email

Adjustment note print out is incorrect when printed through print forms area

Set the PDF Converter to a unique printer port

Payment Summaries disappear from Send Forms in Accounts Business 2014.

Leave Liability Report uses the incorrect Hourly Rate

How do I print my company logo on Reckon Accounts forms?

Uninstall and re-install the Reckon Accounts/Quickbooks PDF converter

Incorrect report date range after selecting "Last [xxx]-to-date

Reckon Accounts Desktop: Payment Summary does not print the Signature of the Authorized Person

Unable to open message store when emailing from Reckon Accounts 2016

Gross Payments Total on the Payroll Transactions by Payee is zero.

Printing INB Payment Summaries for a previous year in Reckon Accounts

Sales by Customer Detail report displays incorrect info when on Gross.

Item Quick report displays no information in the name column

The Print Window appears when using Send Forms to Email Statements

Job Profitability Detail Report shows incorrect Super amounts for Jobs

Why doesnt the Account filter work in the Tax Detail Report

How do I view or print a BAS from the year 2000?

Payslips are not providing totals for Earnings items in Reckon Accounts

Column details are blank when attempting to print a report or export to Excel in QuickBooks

State Payroll Tax Detail Report displays employees in wrong states in QuickBooks 2011/12

Trial Balance has an account called No Account.

Your system might not have enough memory to use Excel when exporting reports

Error: there is no default email client.... when sending an email through Outlook 2010 64-bit

Vendor details centre reports

Profit & Loss/Balance Sheet changed after condensing.

Error Code 1722 - The RPC-server is unavailable, when reinstalling the QuickBooks PDF Converter.

BAS won't print after upgrading to the latest version of Reckon Accounts

Cannot see a General Journal entry to Accounts Payable in the Supplier Centre or on A Quick Report

Invalid ABN error message when filtering for Customer Type in reports

Tax Invoice from yourcompany Message (Plain Text) “Program is not responding” when sending batch ema

Configuring Outlook365 to use Live Mail to send emails from Reckon Accounts Business.

Accounts Receivable by Ageing Period Graph shows an Unexpected Error

Cannot send an email from RA EasyStart on Win10 through Outlook2016

PDF attachment in email is blank

QuickBooks has detected an email connectivity issue.....

Printing an Estimate, Sales Receipt (Cash Sale) or Invoice, an incorrect amount appears

There is a problem connecting to your currently selected printer

Reports Not Calculating The Correct Dates.

Error c=258. Please restart QB and try again when printing or viewing report.

A/R or A/P Ageing Summary Report totals do not match the Balance Sheet

Reckon Accounts Desktop: Processing a Tax Detail Report slow

Installing the "Reckon Accounts PDF Converter" or "Intuit Internal Printer" driver file

Server Busy/Allow or Deny message when emailing from Reckon Accounts

Editing a past pay with leave accruals does not reflect on the Leave Accrual Reports.

When printing a report or form, why do asterisks print in the amount field?

MAPI Error when emailing from Reckon Accounts Business Range

Customer:Job Invoice does not email to the Customer:Job email address

Printer window and error displays when Emailing or Saving As A PDF file in a Terminal Server environ

Remove the paid status stamp on invoices when I print them?

Can't email job statements in QuickBooks.

Transaction Detail by Account Report doesn't display Expenses for LFY to date setting

Printout of Employee Bank Account details from Reckon Accounts

No lines appear on my invoice in Preview or when printed

Microsoft Outlook Warning when sending an email from Reckon Accounts: A program is trying to send an e-mail

The Inventory Asset account balance and Inventory Valuation reports do not match

Price Level list report not showing the new price level on report

Reckon Accounts Desktop: Balance for Australian Taxation Office in Supplier Centre does not match Fast Report balance

Print preview for payslips shows 2 per page instead of 3 per page?

Printing Job Progress Invoices vs Estimates report shows 'X' in Active column for all estimates

Reckon Accounts Desktop: Could not print to printer error

Setting default font size on a report.

Date format formula is incorrect when exporting reports to Excel

Deleting the qbprint.qbp and WPR.ini files.

Error Code - 20 , - 30 or - 41 Printer not Activated in QuickBooks QBi 2010-11 and hangs

Why doesn't my report let me know if it is Cash or Accrual?

Purchases by Supplier Detail Report not able to show Purchase Order No.

Expenses by Supplier Detail report excludes bills assigned to Customer:Jobs.

Cannot open email attachments sent through Windows Live Mail

Filtering by supplier on an ‘Inventory Status by Supplier’ report makes the Sale/Week column zero.

Customising a Profit and Loss report.

Reports do not refresh after modifying a transaction

Why does a cash-basis Balance Sheet report show a balance for the Accounts Receivable (A/R) account?

Statements not printing or previewing

I cannot see / display printer setup in Reckon Accounts

Webmail failing to send email from Reckon Accounts Business.

Company logo does not appear on e-mailed invoices

Tax Detail Report (Cash Net) not match The Tax Liability and Tax Summary Reports.

Default Printer changes to Reckon Accounts PDF converter after emailing.

Reckon Accounts Unrecoverable Error when trying to open Printer Setup

The operation cannot be performed because the message has been changed error when emailing from RA

The printer driver you are using does not support a full range of fonts for this printout

Quantity Column on a Pending Builds report disappears

Cannot find the Paid Invoices Report in the Reports Centre or under the Reports menu option

User denied access to payroll data can view payroll data from a Financial Report

Terminated Employees List prints incorrectly

My printer is not showing in the list of printers in QuickBooks.

Reckon Accounts: Profit & Loss Detail Report Description field shows incorrect memo entry from a General Journal

Alignment is incorrect when printing cheques with remittance in Reckon Accounts

Leave Liability Report does not show custom names for Other1 and Other2 leave categories

Error - Unable to open email message store, when sending an email from Reckon Accounts

The open sales orders reports do not always show the correct details.

Bank Online report does not show edited employee bank online payments.

Reckon Accounts Desktop: Paid Amount differ from the Original Amount on Tax Detail Reports

The Remittance Advice is printing an Extra Border Line.

Group item rate used on sales order does not print out in invoice

Printing Payment Summaries for employees marked for email only

Reconciliation detail report showing all past reconciled transactions.

Uninstalling and reinstalling Reckon Accounts PDF driver. (Amyuni PDF drivers)

Reconciliation Reports automatically print when doing a Bank Reconciliation.

Accounts payable balance does not match accounts payable reports

Error Code -20 Printer not Activated in QuickBooks QBi 2009-10 in Windows 7 32-bit

When I print an invoice some amounts appear as ******

Printing sick accrual hours on payslips

Why aren't my items appearing in Job Profitability Detailed Report.

Tax appears as separate items when Report Settings are changed

When I try to print I get "qbw32 has performed an Invalid Page Fault in module qbwwpr32.dll"

Cannot save as PDF or email from Quickbooks due to printer port assignment ( Nul Port )

INB Payment Summary opens when trying to email a pay slip

Fonts on printed reports do not match screen display?

This action is restricted. For more information, please contact your System Administrator when print

Unable to email payslips from Reckon Accounts

Customers names are missing when reports preference is set to Gross

'Unbilled Expenses by Project' report shows refund cheque for customers.

Tax Code Exception report shows invoices which include Tax codes

Best practice for Save as PDF and Emailing in Reckon Accounts Business 2013

Net basis reports with gross settings

Logo is black when emailing an invoice

Incorrect or missing data on reports

Can’t adjust columns in a report

Overflow appears in account balances and reports

I can't email my invoice , I get a message " QuickBooks Billing Solution "

I don't track tax but still need to print my ABN on invoices.

Gmail block emails from Reckon Accounts Business

Sales Receipt appears in the Missing Cheque Report

Statements take a very long time to print.

Printing performance tips

There is no barcode column in the Item Listing report.

Two "Tax Code" column headings exist in the transaction detailed reports

Reckon Accounts Desktop: Class column in the Supplier Balance Summary/Detail report is missing

QuickBooks crashes when opening a Report

Printer setup failed. Error Code 1722. The RPC-server is unavailable

Sales transactions do not appear when generating the Tax Agency QuickReport

Tax Detail Reports - Cash Net and Cash Tax( Does not show all the transactions)

Unrealized (Exchange Rate) Gain & Loss Report does not refresh in Reckon Accounts 2023

Paid bill or invoice is listed as past due on the ageing reports

Tax Detail Report shows only Cash Tax and not Cash Net on EasyStart

Additional fields within reports

Thunking Spooler APIS from 32 to 64 Process has stopped working

Sending an email from Accounts Business takes a very long time

A/R Ageing Summary Report is not sorted correctly

RESC on Payment Summary is incorrect or does not match totals in Payroll Summary Report

Error: ‘The tax account does not exist. There is no data on which to report” when generating a Tax Detail Report

Printer not activated, error code -60, -41 or-30 when Saving as PDF or emailing in RAB (Server only)

Configuring and sending emails through Thunderbird

Incorrect dates for reconciliations reports.

Invoices in print form option

Employee has 2 super funds listed in the Fund Scheme column on the Super Report by Employee

Winmail.dat rather than invoice or statement attachment is received by some email recipients.

Payment Summaries for emailing disappear from the Send Forms area

The mail api was given an invalid value, possibly an invalid email address in Reckon Accounts when emailing

Payment Summary - Period during which payments were made date is reporting incorrectly.

Deposits with Tax codes not reported correctly.

Why does my FastReport not reflect recent changes I have made?

The report you requested is too large and cannot be displayed

Reckon Accounts Desktop: Balance Sheet Summary Report displays the heading "Summary Balance Sheet"

Credit Card Refund transactions without tax codes do not show on the Tax Code Exception Report

View Only Role with Memorized Report List permission of None, allows access to reports in Reckon Accounts

Reckon Accounts Desktop: Employees not appearing in Payment Summaries screen

Asking for a 5-digit numeric prefix to print a tax invoice

Unable to Email Using Hotmail & Webmail Feature in Reckon Accounts Desktop

Transaction report on COGS shows some Bills when only Invoices & Sales receipts should show

Underlined amounts on the Balance Sheet

Paid Invoices Report shows all invoices paid from the start date of the company file and not last FY

Group item rate used on sales order does not print out on invioce.

Some Items do not display on the Purchases by Item Summary Report

Editing leave hours on a previous pay does not reflect on the Leave Accrual Reports.

My Collections Report shows transactions under No Name

Leave Liability Report uses incorrect rate for ADP leave

My A/R Ageing Detail report doesn't match my A/R Ageing Summary report.

My COGS account seems to be incorrect on a Profit and Loss report.

Reckon Accounts: Profit and loss report filtered by class only showing a portion of allowance amounts entered for an employee

Why do I get the incorrect headings on my printed invoice when I add the Company Information to it?

Subject when emailing invoices.

Sales receipts with no customer selected are not included in the Item Profitability report.

Printing Job Progress Invoices vs Estimates report shows 'X' in Active column for all estimates

Printing BAS/IAS when printing 1st BAS/IAS is in progress

Cannot zoom in to Tax report to see details in Reckon Accounts

Can't display Supplier's Tax Rego ID in any reports

Unable to remove a column from the Leave Accrual Summary Report

I want to pay my bills using EFT payment, Direct Debit as a payment method and not as a cheque to be printed.

How do I resolve printing issues if I have LapLink software installed on my computer?

Reckon Accounts Desktop: Cannot email a report as an Excel file

Webmail and Reckon Accounts Business

Trial Balance is out by an amount that shows in an account called 'No Account'

Accounts receivable aging reports show invoices as overdue when they are current, or as more overdue than they should be, according to terms set up.

Tax Liability Report showing no amount or 0.00 when there should be an amount

Printer not activated -20 error when emailing or Save as PDF after upgrading to Windows 7 and later.

RESC amount on STP is incorrect or does not agree with my payroll reports

Underlined Amounts in the Profit & Loss Report

Company Snapshot Income and Expense Trend Graph shows incorrect values

Changing report basis from cash to accrual (or vice-versa)

Bank (Online) Report will drop banking details when printed

Some Cash-Basis Reports show unpaid transactions

Cannot deselect columns from a Leave Accrual Summary Report

Creating a report that shows a bill and the transactions linked to it

Send Forms list is blank and there are no forms to email

Unable to locate PDF viewer when trying to display a Reconciliation Report

figure at the bottom of the Tax Liability report for purchases and sales

Reckon Accounts: Payslips do not conform to Printing Preferences

State Payroll Tax Detail Report shows Customer Name and not Employee Name

Unable to Print GST 101 Form

Why are the numbers on my Profit and Loss Report incorrect?

Unable to reconcile accounts or to create, print or email PDF files in QuickBooks QBi

Reckon Accounts - Bank/Credit Card and Reconciliation Issues

Online Banking Centre for Reckon Accounts

Transaction on the Imported Bank Statement is already matched to the bank account

Last transaction of imported bank statement (QIF) does not import into RAB

Cash Sales aren't in Bank Account

ABA Preview shows blank or zero amount or contents of previous session or from another company file

The month of the Expiry Date on a Credit Card always changes to 12

An error occurred while processing your online banking data when importing a QIF file into QB

Error Message 'C=238 When clicking on Go Online Button'

Banking details are missing when lodging an ABA export file.

Can I change the name of the Undeposited Funds account?

You must enter a value for all of the fields on the Online Info tab when configuring bank account

Error 522 when signing up for a Credit Card account

Deposit of Payments is Out Of Balance.

ANZ Business One Credit Card - You dont have permission to request bank feeds for this account

Cannot upload ABA file to Bank – all bank and APCA details are correct

Reckon Accounts Payment Services - Transaction Handling

Unable to Preview ABA History files, I get the error " There is no ABA file History for (Your bank)"

Missing information from a Commonwealth Bank QIF file

Reckon Accounts Desktop: \Select Bank Account greyed out when importing files

Cannot identify a transaction when Transaction Rule set to match Payee name Exactly

Reckon Accounts Desktop: Finding cleared transactions that have been changed or deleted

Bank Account number incorrect for a Yodlee BankData feed

Credit Card Icon opens information for US QuickBooks

Reckon Accounts Desktop: Splitting Employee Payment Methods

Handling Online Banking and BankData configurations in the one company file

Incorrect beginning balance in Begin Reconciliation window

Unable to create the ‘\’ Folder . The system cannot find the path specified.

Customers ABA file will not import into the bank account.

Bankdata and QIF imported transactions duplicated

Process Credit Card Payment option is Greyed Out when entering a sales receipt or payment

BOQ BankData - You dont have permission to request bank feeds for this account

Unique displays for some Bank Account and Credit Card numbers accessed by Yodlee Feeds

Bank Transfer to an Online Bank Account does not appear in Send section of the Online Banking Centre

Can't save changes when editing a bank account, I don't have exclusive use?

Storing the CVV number for Credit Cards in Payment Services

BankData Signup screen hangs when signing up for a Credit Card account

QuickBooks does not respond when you click Reconcile Now

Remittance Advices from a Credit Card payment

Reckon Accounts crashes when importing QBO files over a certain size.

Inactive Bank and Credit Card accounts available in Pay Bills dropdown menus

Multiple transactions appearing in bank register when processing employees pay run ( cash pays )

Error - Bank Account BSB and Number must not be empty when uploading a SAFF file to OzEdi

Entering Bank Fee and Interest Charges in QuickBooks QBi

Bank account options greyed out when importing Bankdata transactions into Reckon Accounts

Online Bank Account is not retained when paying bills

QuickBooks has encountered a problem and needs to close when Reconciling a bank account

Removing an account from your Reckon Accounts BankData Record

Reckon Accounts Desktop: Cannot import a bank statement from CommBiz (CBA)

Entering Bank Fee and Interest Charges in Reckon Accounts

Why does my reconciliation default to a bank account which is inactive?

Cannot access the Online Banking Centre from the Banking menu

QIF Bank Statement file converts to QBO but is not delivered to the Online Banking Centre

Cannot delete a Credit processed through Payment Services

You dont have permission to request bank feeds ….. error after creating a new Yodlee feed.

Reckon Accounts crashes when importing bank statement from ANZ and Suncorp financial institutions.

Zeros replace Yodlee ID or Branch Code fields after a successful BankData Import

Deleting a Reckon Accounts BankData subscription

Online Banking cannot log onto the Suncorp-Metway internet banking site

Tax doubles up when adding Credit Card transactions through Import Bank Statement

Last transaction of imported bank statement does not import into NZ QuickBooks

Error 522 when adding a Bank account to BankData through Yodlee

ABA File (Online Banking) - Duplicate Entries From Previously Created File

ABA file being rejected by the Bank

Bank Amount incorrect in a Payroll YTD Adjustment

QBQIF2OFX - Run-time error 5 when importing QIF manually

Reckon Accounts Desktop: Bank rejects the ABA File saying it is out of balance

Reckon Accounts Desktop: Cannot Create or Replace ABA pages when opening the Online Banking Centre in Reckon Accounts

Having two online Bank Accounts with the same Account numbers

Adding a bank statement reference for a pay paid by online banking in Reckon Accounts Business.

QIF file from St George Bank does not import

Reckon Accounts Business (QuickBooks) hangs when click Reconcile Now

Error: You can only deposit to Bank or other current asset type accounts

Recovering lost downloaded BankData transactions on Accounts Business

How can I find a cleared transaction that was changed or deleted since I last reconciled?

ABA file being rejected by bank

Why are invoices and their items appearing in the bank account?

This application has failed to start because stlport_r50.dll was not found.

Strange files and folders appear on my desktop after I import QIF file into QuickBooks.

Reckon Accounts has detected that the APCA number is missing. You need to enter a number before generating an ABA File.

Unable to download Credit Card transactions through BankData into Reckon Accounts

Why is my ABA file being rejected from ANZ after being exported from Reckon Accounts Business/Hosted

Reckon Accounts - GovConnect (including BAS) Issues

Creating a BAS for a period more than 2 years ago

Cannot log onto GovConnect - The keystore you selected is invalid

Uploading BAS to ATO’s ECI portal fails

After configuring the BAS zeros still appear.

Why don't my BAS and Tax Reports match?

Error Obtaining Security Token during List Request in GovConnect

Handling Layby payments in Australian BAS and Business Tax Returns

BAS window doesn’t fit on the screen

Duplicate GST's on partial payments in BAS

PAYGI information (5A field) from BAS Lodgement form does not appear in GovConnect

BAS Lodging causes error on style sheet - 'The parameter is incorrect'

My BAS settings are missing after I restore a backup?

BAS and Tax Reports do not match after paying a Bill using the Write Cheque facility.

BAS form format is unknown. This file will not be saved or exported

Error: The parameter is incorrect- When lodging the BAS electronically

T4 Require a Reason code for variation when submitting BAS through GovConnect

Internet connection failure when logging into GovConnect.

Error: "BAS form format is unknown. The file will not be saved or exported" when saving the Instalment Activity Statement

GovConnect: Invalid Company Information error

Area Code field is blank in Reckon GovConnect

After Upgrading QuickBooks the BAS doesn't bring up any figures

BAS/IAS fields 8A, 8B & 9 show incorrect amounts

Why do 1A and G1 in the BAS not agree with my tax reports?

BAS W2 figures are incorrect

Calculation Sheet BAS

There is a connection failure message when lodging BAS through GovConnect

Have not received confirmation that BAS was processed through GovConnect

BAS is blank the first time I use it.

Asked to Refresh BAS in Reckon Govconnect to update, when lodging BAS through GovConnect.

The system (GovConnect) has encountered an Unexpected Error - Error Code is A511.04

GovConnect crashes with an unexpected error

Exception message when making a List Request in GovConnect

How do I switch my BAS to Cash or Accrual?

BAS is still incorrect after confirming Tax Reports are correct

The BAS report does not always include transactions on the 29th February.

Including Pays information in BAS when not using the Accounts Business Payroll function.

IE has modified this page to help prevent cross-site scripting when uploading BAS

Drop down menu in BAS are not wide enough, items are being cut of and are hard to read

1B field on BAS reporting incorrectly

BAS Lodgement form is blank after upgrading

My G11 and 1B fields on the BAS differs from the Tax Summary Figures.

Payee Record Count must be equal to the number of children (PAYEVNTEMP) - STP Submission Error

Incorrect amount reported at BAS W1

Reckon Accounts - Accountant's Copy/Changes Issues

Reckon Accounts Desktop: A problem was encountered when trying to import your Accountant's Copy

Error: These changes do not match the current company and cannot be imported when attempting to import Accountant's changes in Reckon Accounts

Value of Cheque changes when tax code changed in Accountant’s Copy

Reckon Accounts Desktop: We are unable to display the Accountant's changes error

In ADT, how do I get rid of the existing mapping(from previous clients)?

Error - the specified record does not exist in the list – when importing an Accountant’s Copy

No message that importing Accountant’s Changes has failed

Cannot convert Accountant’s Copy (QBX) to an Accountant’s Working File (QBA)

Deposit memo details entered in Accountant’s Copy does not get imported into the company file

Company File is corrupted when importing Accountant’s Changes

'The given object ID "" in the field "list id" is invalid' when importing Accountant's Changes for a Bill in Reckon Accounts

Reckon Accounts - Multi-Currency Issues

Account has the wrong currency, it had transactions in US currency, now it is AU. This is in a Multi-currency file.

Display home currency option

Audit Company File Wizard - audit checks when a foreign currency a/r account exists

Update to Item Price from a foreign currency denominated Bill does not recognize the foreign currency

MultiCurrency Progressive Invoice

Understanding Net Worth Reports in a Multi-currency Reckon Accounts file

No Currency Assigned to Accounts Created in an Accountants Copy

Why is the item price incorrect when I change to a different currency customer?

Group Item price shows incorrectly on a Customer Statement in a Multi-currency file.

Foreign Currency Bill resets to Paid and is zero

Customer currency does not match your currency

Reckon Accounts - Import, Export, Upload, or Conversion Issues

Importing the IIF file in Reckon Accounts Business, changes the Inch “ symbol to Feet ‘ symbol.

Bank Account BSB and Number must not be empty error when uploading to a SuperStream Clearing House

Export to Excel option is greyed out

Date format changes after exporting to Excel

Special Leave taken is not exported to Reckon Accounts

MYOB Converter fails when trying to import data from exported data files.

Cannot upload a customized SuperLink Export Report to the SuperLink website

My data file loses integrity after importing a QIF file in multi-user mode

When exporting forms the logo isnt exported.

No transactions received for this account during online activity – dd-mm-yyyy when importing a bank

Accounts Business crashes when mapping data for import.

Importing an IIF file fails with error: “missing required TAXABLE field”

When export my Employee List, I get several C=10000 messages

The help menu is not working in my MYOB converter tool, I need to Export MYOB data

Imported remittance advice shows incorrect wording (Tax as VAT)

Customer details missing after exporting from payroll.

QuickBooks Crashes when importing my QuickBooks Timer file.

Export to Excel does not work

Customer Job address details are erased in QuickBooks after Payroll import

Error 3163 - The field is too small..., importing from Pro-Timer

Reckon Accounts Desktop: Transaction is not in balance when using an item recently imported through an IIF file

Phone Number Field must be a number message when uploading Super Data Export to NAB SuperPay

Reckon Accounts Hosted: Cannot export to IIF

Date format in exported excel spreadsheet is incorrect

Adjust Payroll Liabilities message appears when importing an IIF file.

Can I import Reckon Timer activities into a different Reckon Accounts File?

Error: The taxable setting in tax code NCG (or GST) has been changed. This can not be imported.

Reckon Accounts: File has more columns than required error when uploading Super Export file to NAB SuperPay

"The transaction is not in balance..." when importing a Payroll Premier Export File where Reimbursab

Reckon Accounts Desktop: The date is in the wrong format, the correct format is MM/DD/YY

Weekly Hours is set to zero when importing Employee IIF in Reckon Accounts

Reckon Accounts - Memorised Items (Transactions, Reports, etc) Issues

Unrecoverable Error when attempting to view the memorised transaction list.

Memorise a cheque without a number.

Unrecoverable error when trying to open the Memorised transaction list.

Reckon Accounts - Template Issues

Invoice template is printing with unrecognized font or jumbled up characters

Template selection not retained

QuickBooks Letter Templates are not updated when applying QuickBooks 2008/09 SP2 (R8)

Quantity, Rate and Item column on customised Statement Template.

Fields do not align on the Invoice Template

Remittance Advice emails or prints in default template and not customised template used

Reckon Accounts: VAT wordings appear in imported invoice templates.

All Templates corrupt

Why can't I add my ABN to my Statement Template.

Reckon Accounts - Items and Inventory Issues

How can I change the cost price of items?

Average cost, inventory asset account value, or COGS incorrect (or zero)

Reimbursed amount (price) for service items under time/costs.

Tracking trade-in cars as inventory

Out of Balance warning when adjusting a previous Adjust QTY/Value on hand transaction

Changes to COGS and average cost when selling inventory items not in stock

Inventory on Hand on Item List does not match Adjust Quantity/Value on Hand form

Inventory levels are wrong after processing a refund from a supplier

Percentage discount item cause a problem if the form is set to include tax.

Ref No does not update when Inventory Adjustment form opened

Setting up Bin Locations for Inventory Items

Inventory Adjustment Form Ref No does not change

I can't edit or enter a barcode to an already existing item.

Reckon Accounts Inventory Tracking in separate warehouses or stock rooms

Reckon Accounts - General Journal Issues

Reckon Accounts Desktop: The Transaction is not in balance error in General Journals

Recording a Journal Entry

Transaction Journal shows an account entry assigned to a Customer:Job

Out of Balance error when changing the Tax Amount on a General Journal

"Transaction Split lines to accounts payable must include a supplier on that split line" when entering a general journal

The No Tax Code Filter doesn't filter Gen Journals correctly

Reckon Accounts - Verify and Rebuild (QBWIN.LOG) Issues

QBwin.log Error: Verify Name Balance failed. Name = Australian Taxation Office

QBwin.log level_error_connection _connectionstring and _dbconnpool

QBWin.log Error: "GetDecryptedCreditCardNumber Failed"

QBwin.log error:

QBWIN.LOG Error: Verify Target: Values in minor do not match major

QBWin.log error: LVL_ERROR--Returning NULL QBWinInstance Handle

QBwin.log error: QBAdminGroup.abmc_current_users: Run time SQL error -- %1

QBWin.log error: Verify item history Target quantity on order mismatch error

Error: "QBW32 caused an IPF in module qbwin32.dl." -OR- "QBW32 caused an IPF in module unknown."

"Call to get service manager handle failed. (main2.c)" and "OAstdMethodRet (80042101)" in qbwin.log

Reckon Accounts - Tax Invoice Issues

Incorrect rounding on invoices when entering in certain quantities and amounts.

Error when converting a Sales Order to an Invoice: This item was created from a Sales Order. You m

Removing the Australian Tax Total field from invoices

“To be emailed” box on the Invoice form is not ticked automatically.

Invoice Tax Total is not 10% of Net Total

Invoice that contains a Reimbursable Group shows the total Reimbursable Expense incorrectly

Due Date appears beside my invoices on the statement?

How do I fix payments applied to the wrong invoices?

Defaulting invoices to amounts include tax

Customer ABN number doesn't appear in the progressive tax invoice.

The string Copy of: Quicken Service Invoice in the file FulName is too long.

Employees name on the invoice when using time/costs.

Invoice's total amount out by a few cents when applying negative amounts to an invoice

Terms and Rep fields do not populate correctly when creating an invoice for a customer job.

Other charge item percentage calculation is wrong if the invoice is inclusive of GST.

Out of Balance error when saving an Invoice

Strange characters appear next to the total amount on invoices, eg, a 'J' instead of a '$'

Reckon Accounts Desktop: Subtotal displaying an incorrect amount on invoices

Reimbursing time as one item on an invoice

WC no longer displays breakdown in summary section

Invoices due at the end of next month.

Negative amounts on Invoices causes the Trial Balance to be out on a Cash & Gross basis

The option for "Amts Inc Tax" does not stay ticked/unticked

Open Invoice does not appear on Statement to Customer when All open transactions as of Statement Dat

Reckon Accounts Invoices To Be Sent Does Not Have Current/Updated Details

Creating a Recipient Created Invoice. (As apposed to recieving a recipient created invoice)

Sales Total on a Quickbooks Invoice does not meet legal requirements

Payment by Credit Card does not mark the Invoice as paid.

Although fully paid some invoices are still showing outstanding amounts.

001 or Branch number display after the ABN on invoices

Reckon Accounts - Bill Issues

Entering a Yellow Pages bill with first installment amount and full tax amount in QuickBooks

Changes to Item Description of a billable expense on a bill not reflected on the invoice

Cannot select the correct Customer:Job to make a Bill billable

Tax appears on Bill created from Foreign Purchase Order when there should be no tax

Part payments on bills

Incorrect total and tax amount when using timesheets with a bill and Amounts inc tax ticked.

Different total amount figures when entering a bill incl/excl of tax.

Out Of Balance Bills - c=75

Out of Balance error after changing the Exchange Rate on a Bill from a foreign supplier

Some payment method options in Pay Bills are missing.

My tax code does not change when assigning a billable item from a bill to an invoice.

Customer Job and Billing columns missing on a Bill form

'Ref No.' in Enter Bill window.

Error: 'Account not found' when entering a Bill.

Reckon Accounts - Payroll-related Issues

Invalid Tax Number - Employee PAYE tax number field changes to ‘0’

Unable to access Employee Organiser options in Reckon Accounts

Employee List sorted by Class reverts to an alphabetical order on the Enter Payroll Information wind

The Employee TFN in the Super Export file is longer than NAB SuperPay allows

Super amount above official SA rate does not appear in RESC field

C=239 when editing an employee in Reckon Accounts

Leave not accruing at all when creating pays

Cannot adjust Student Loan Deduction for the Special Deduction Rate on secondary earnings

Handling an employee that has both WT and M SL Tax codes

Can no longer select Superannuation Trust of Australia Super Fund

Modifying the date or pay period without unlocking the net pay will cause incorrect RESC reporting on Payment Summaries / Empdupe file

NSW State Payroll Tax threshold showing the incorrect amount in QuickBooks 2011/12

Student Loan Not Calculating

Details do not save for an Employee created in Reckon Accounts Business 2016